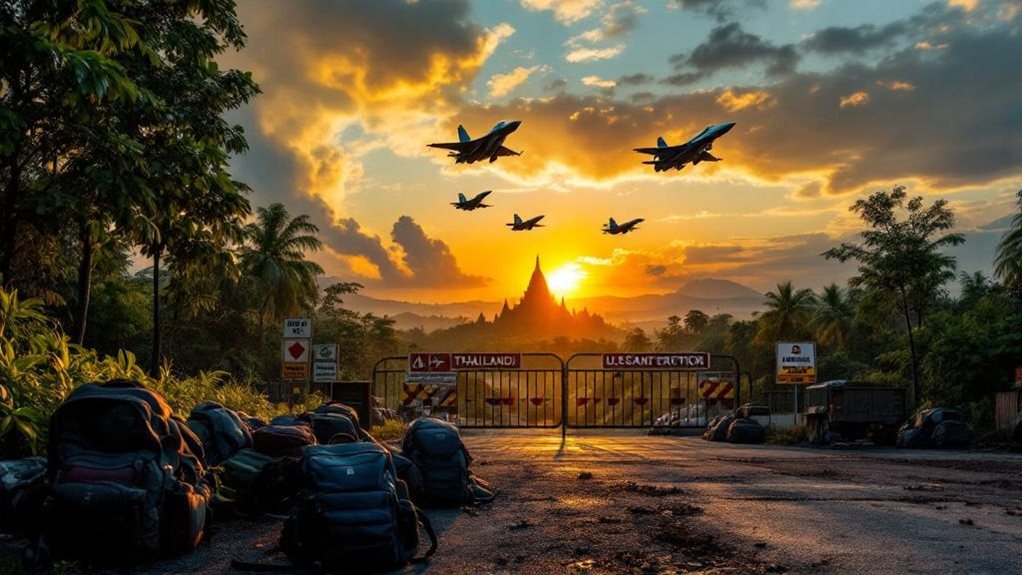

Thailand’s tourism industry is experiencing instability in 2025, driven by a sharp drop in Chinese arrivals and increased safety concerns following regional events, such as the Myanmar earthquake. Despite Bangkok’s high visitation figures and a rise in overall international arrivals, revenue targets have been revised downward, with Chinese tourist numbers slashed from 8 million to 6.7 million for 2024. Government campaigns and infrastructure improvements aim to offset these losses, while ongoing challenges complicate the sector’s full recovery. Further insights show how these factors shape Thailand’s tourism future.

Although Thailand has long been recognized as a leading global destination, the nation’s tourism sector is currently facing significant instability due to fluctuating international arrivals and shifting market dynamics. In recent reports, Thailand’s capital, Bangkok, attracted 32.4 million tourists, with average daily spending around 167 USD per visitor.

Thailand’s tourism faces instability as international arrivals fluctuate, with Bangkok drawing 32.4 million visitors averaging $167 daily spend.

Early 2025 data indicated over 11.27 million international arrivals, generating approximately 540.6 billion baht, or about 16 billion USD, in revenue. The first quarter alone registered 9.5 million international visitors, a 2% increase year-on-year, and yielded 471 billion baht, up 7% compared to the previous year. However, despite overall growth, there were temporary declines in some months, particularly noticeable after the Songkran holiday in April 2025. Tourism and travel accounted for 8.9% of the nation’s GDP, underscoring the sector’s critical role in Thailand’s broader economy.

A significant contributing factor to this volatility has been the sharp decline in visitors from China. Earlier in 2025, Chinese tourists led arrivals with 1.52 million visits, but recent months saw a marked reduction in this segment, impacting revenue and raising concerns about the sector’s resilience. The target for Chinese tourists was recently revised downward from 8 million to 6.7 million for 2024, reflecting the ongoing challenges in this market.

The Chinese market had previously been a cornerstone of Thailand’s international tourism, and its contraction has prompted government interventions such as visa exemptions and targeted promotions in an effort to recover lost ground. Analysts note that this decline is partly attributable to geopolitical and economic issues affecting Chinese travel behavior, complicating recovery prospects.

Government revenue and tourist number targets have also been affected. The initial goal for 2025 was 3.5 trillion baht in tourism revenue, supported by 39 to 40 million foreign tourists and over 203 million domestic trips.

Revised strategies now aim for 2 trillion baht in international tourism revenue, matching pre-pandemic levels from 2019. Domestic tourism remains essential amid these uncertainties, with campaigns such as “Amazing Thailand Grand Tourism and Sports Year 2025” launched to stimulate arrivals and spending.

External and regional challenges, including the March 2025 Myanmar earthquake, ongoing geopolitical tensions, and competition from neighboring Southeast Asian destinations, continue to shape traveler sentiment and impact Thailand’s tourism recovery efforts.

Infrastructure improvements persist, yet regional instability and global economic uncertainties remain considerable obstacles.