A unified visa for Southeast Asia, similar to Europe’s Schengen scheme, could greatly streamline travel across tourism leaders like Singapore, Thailand, Malaysia, Vietnam, and Indonesia. This approach would simplify border procedures, attract more international visitors, and foster regional economic growth, supporting the sector’s projected US$32.6 billion revenue by 2025. Digital infrastructure advancements and regional cooperation further improve feasibility, while emerging markets like Vietnam benefit from increased connectivity. Exploring this proposal reveals complex impacts on competitiveness and cross-border tourism initiatives.

Southeast Asia’s tourism sector stands as a major driver of economic growth in the region, with the travel and tourism market projected to generate US$32.60 billion in revenue by 2025. This figure is based on a compound annual growth rate of 5.22% from 2025 to 2029, reflecting sustained momentum across hotel bookings, vacation rentals, cruises, and package holidays. The market’s expansion draws from demand for authentic, culturally immersive, and highly visual travel experiences, often influenced by social media trends. Market sizing relies on a combination of financial reports, consumer surveys, and industry data from organizations such as the UN World Tourism Organization, ensuring thorough analysis.

Key tourism markets in Southeast Asia include Indonesia, Malaysia, Singapore, and Thailand, which collectively represent the majority of the region’s travel activity. Emerging destinations such as Vietnam are now challenging these established leaders by offering distinctive cultural and natural attractions, along with improved tourism infrastructure. Online sales are expected to account for 73% of total revenue by 2029, underscoring the growing importance of digital channels in the region’s tourism landscape.

Countries in the region have adopted varied strategies to attract different traveler segments, leveraging their unique assets and digital platforms. Infrastructure modernization and growing digital connectivity further support the sector’s competitive positioning. The recovery of Southeast Asia’s travel market is expected to be incremental, with gross bookings likely remaining below 2019 totals by the end of the current forecast period.

In Singapore, international arrivals are expected to reach nearly 16 million in 2025, surpassing pre-pandemic levels by 9.6%. India and China are particularly significant source markets, with projected arrivals of 1.25 million and 2.8 million, respectively. Singapore’s strong air and urban connectivity continues to underpin its tourism growth, positioning it ahead of regional competitors such as Thailand and the Philippines in inbound visitor forecasts.

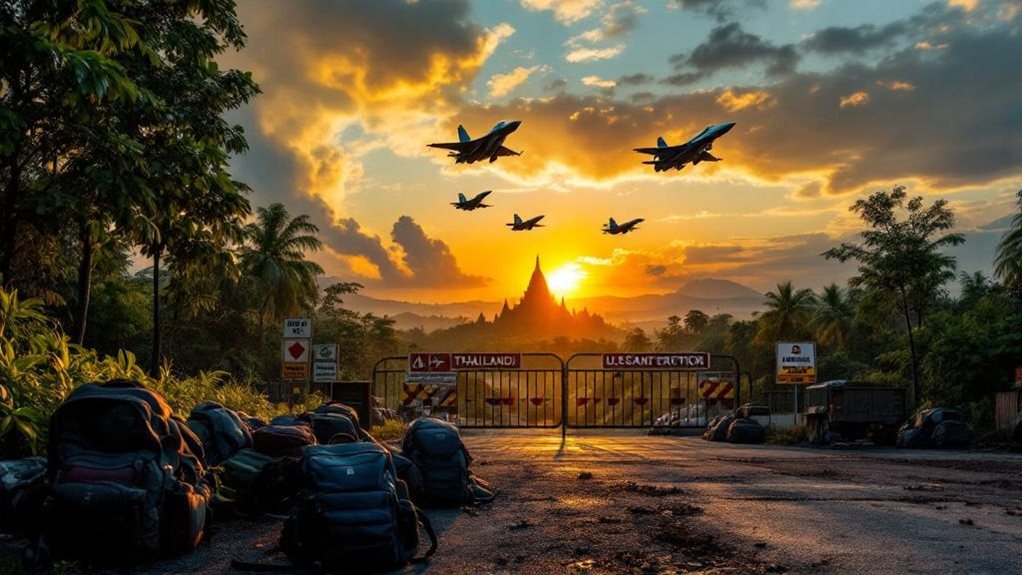

Thailand remains the top destination by arrival volume, recording 35.5 million international visitors in 2024 and forecasting 5% growth for 2025. While it faces challenges from slower Chinese outbound travel, increased arrivals from India and other markets have improved its tourism resilience.

Vietnam, with 17.5 million arrivals in 2024, is the region’s fastest-growing market and aims for 23 million visitors in 2025. Malaysia and the Philippines, meanwhile, are set to surpass or closely match pre-pandemic visitor numbers, supported by renewed travel demand and diverse offerings.

Regional cooperation, such as a unified visa, could further facilitate cross-border tourism and sustain growth.